Navigating Carbon Markets: A Brief Guide

Carbon markets underscore the importance of aligning economic incentives with environmental goals for a more sustainable future. The agriculture industry can benefit farmers financially and help them adapt to climate change when combined with carbon markets.

Published on 16 August 2023

What are Carbon Markets?

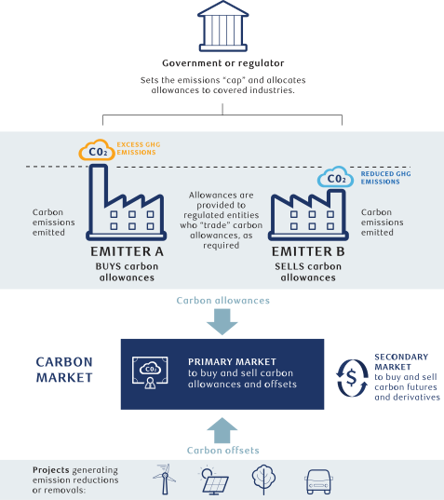

In carbon markets, buyers and sellers trade permits, offset certificates, or reductions for greenhouse gas emissions. Regulatory bodies and international organizations assign a price to carbon emissions, making them a factor in economic decisions.

Carbon markets make companies and individuals accountable for emissions' financial impact. They value conservation efforts, like preserving forests, by monetizing carbon sequestration. Carbon markets integrate environmental costs into the economy, encouraging global emission reduction.

How big is the carbon credit market?

Compliance carbon markets have grown substantially over the two decades. In 2022, the carbon credit market is worth around $100 billion globally, with a trading turnover of about $250 billion. The voluntary markets in comparison, are not so big, worth around $300 million. However, the carbon credit market size has been growing rapidly over the last two years, about 20 percent per year.

What are compliance Carbon Markets?

Compliance carbon markets (CCMs) encompass systems where companies utilize carbon allowances or offsets to satisfy regulatory mandates for emissions reduction. These markets hold significant importance as they establish a monetary value for carbon, motivating businesses to undertake decarbonization efforts. These markets are not singular but comprise more than 20 distinct systems worldwide, with more emerging. Leading CCMs include the EU, China, California, and East Coast in the US and various small ones in New Zealand.

There is no one smooth market, they’re all different, and the prices can vary. But regulators compare the systems, and we might see some of them synchronized in the near future. The mechanisms range from using an open-auction model to allocating a certain amount of credits, which people then trade.

What are Voluntary Carbon Markets

Voluntary carbon markets allow companies to meet environmental obligations and invest in emission-reducing projects. They are separate from compliance markets and can go beyond the minimum requirements set by global carbon reduction regulations.

How do Carbon Markets work?

The carbon credit markets operate through various mechanisms within both compliance and voluntary markets. In some markets, like the European Emissions Trading System (ETS), regulators set a limit on how much carbon companies can emit. Those exceeding the cap must purchase additional carbon allowances, while those emitting less can sell their excess allowances.

This trade facilitates a balance of emissions to meet regulatory limits. Various factors determine the cost of carbon allowances. These factors include the cost of alternative actions and the cost of reducing emissions. As a result, companies must take into account the cost of carbon when making decisions.

Conversely, the voluntary carbon market faces challenges due to a lack of liquidity and variety among carbon credits. Attributes of an underlying project determine the value of each credit. The current process of matching buyers and suppliers is inefficient due to credit disparities.

There's a need for standard features in carbon credits to enhance efficiency. Standard features involve establishing quality criteria to ensure genuine emissions drops and standardizing attributes within a common taxonomy. Standardization allows sellers to effectively market credits and better align with buyers' preferences, enhancing the functionality of the voluntary carbon market.

(Understanding carbon markets (rbcgam.com))

How can we prevent oversupply in carbon markets?

Regulators can prevent carbon trading markets from oversupplying by setting suitable emissions reduction targets and caps that align with goals. Regular reviews and adjustments are vital. Introducing mechanisms to withhold or retire credits temporarily if oversupply looms is essential.

Monitoring, reporting, and verification systems maintain integrity and prevent flooding. Consistent accounting methods and transparency across markets bolster credit credibility.

How to invest in carbon markets?

There still isn’t a well-developed retail market for the voluntary carbon markets. Corporations and institutional investors have a better selection, as they can negotiate directly with carbon offset projects. Still, individual investors can start by considering Carbon Mutual Funds, ETFs, and green companies that create credit.

Carbon Markets and Agriculture

The agriculture industry can benefit farmers financially and help them adapt to climate change when combined with carbon markets. Carbon markets provide a mechanism for encouraging farmers and landowners to adopt more sustainable and climate-friendly practices. Agricultural stakeholders can generate carbon credits by reducing emissions or enhancing carbon capture.

Farmers can use regenerative farming practices to create carbon credits by increasing soil carbon sequestration. They can then sell their carbon credits to companies that want to offset their emissions. As such, companies can start to effectively support sustainable agricultural practices while meeting their emission reduction goals.

Overall, carbon markets underscore the importance of aligning economic incentives with environmental goals for a more sustainable future. Early adopters will be leaders in climate financing and play a key role in shaping the mechanisms by which the markets operate.

For those interested in exploring how Doktar's innovative solutions can transform your agricultural practices, visit our website for detailed information on all our products. Stay updated with the latest developments by following us on Instagram and LinkedIn, where we share insights, tips, and updates about our technologies and their impact on modern farming.

References:

Carbon Market | UNREDD Programme

Carbon credits: Scaling voluntary markets | McKinsey

The path to net zero: Investing in carbon markets | McKinsey

How to Invest in Carbon Credits, Carbon ETFs, and Carbon Stocks

Agriculture Technology and Data-Driven Harvests

The convergence of agriculture technology and data-driven solutions represents the next frontier of innovation in farming. With companies like Doktar leading the way, farmers can leverage these advancements to improve productivity, reduce environmental impact, and secure a more sustainable future for agriculture. Whether through precision agriculture, sustainable agriculture, or cutting-edge smart agriculture technology, the future of farming is bright, and data is at the heart of this transformation. Technology's positive impact on this future should inspire and motivate us all.

Integrating Crop Health Monitoring Systems for Better Farm Management

Crop health monitoring systems revolutionize modern agriculture by enabling real-time insights into plant health, reducing losses, and promoting sustainability. Tools like Doktar’s CropMap and Orbit integrate advanced technologies, empowering farmers with data-driven decisions. By enhancing efficiency and sustainability, these systems are essential for future-proofing agricultural operations.

Modern Agriculture: Innovative Solutions to Combat Global Food Insecurity

Modern agriculture combats global food insecurity with precision agriculture, sustainable practices, and biotechnology. Tools like IoT, automation, and crop innovations optimize resource use, enhance resilience, and ensure stable food supplies. By integrating smart technologies, agribusinesses address challenges like climate change and resource scarcity, paving the way for a sustainable food future.